Auto Five — Oct 16, 2025

Published: Oct 16, 2025 · AAPL · TSLA · NVDA · COIN · SHOP · AI-Powered Market Intelligence

📌 Today's Snapshot

- Market Mood: Cautious trading with profit-taking in mega-caps VIX elevated at 25.3 signals increased uncertainty.

- Stocks Today: AAPL · TSLA · NVDA · COIN · SHOP

- Setup: 1 bullish, 4 neutral, 0 bearish

🌍 Market Context

🏆 Today's Movers

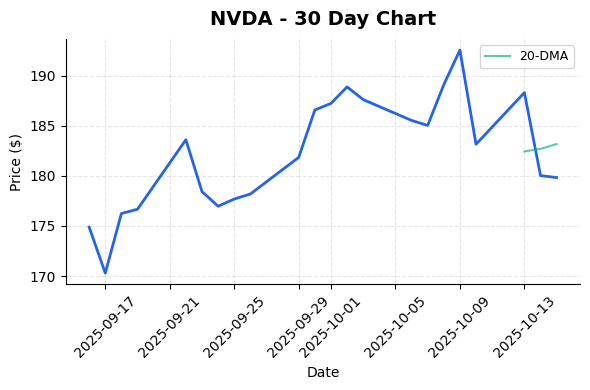

Top Gainer: NVDA ↑ 1.10% — Data center buildout

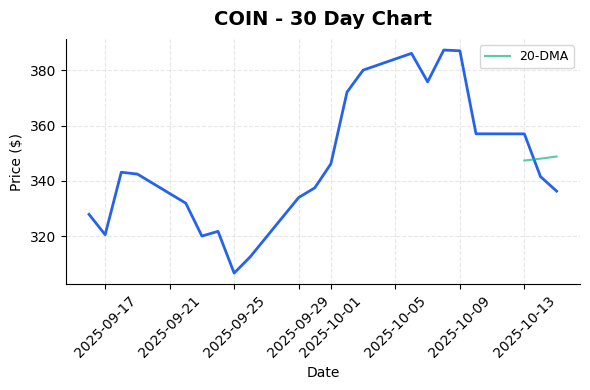

Largest Decline: COIN ↓ -1.80% — Crypto market sentiment

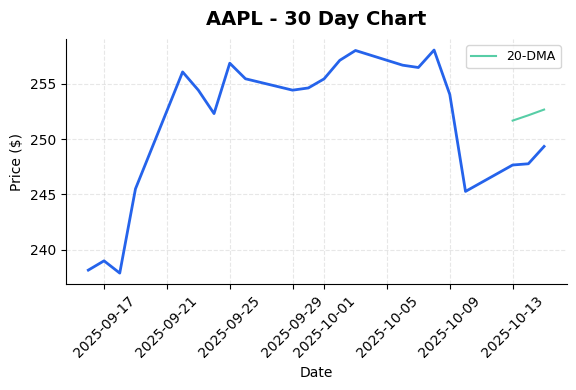

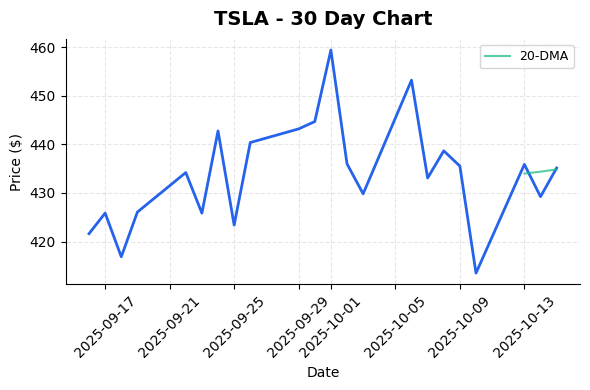

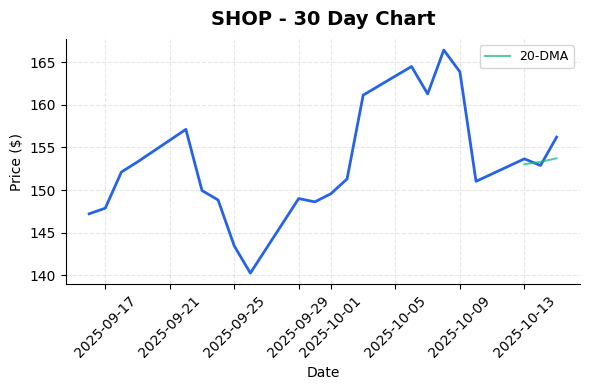

📊 30-Day Charts

📈 Detailed Technical Analysis

AAPL — $247.45 (-1.89 / -0.76%)

💡 Catalyst: Services growth momentum

🎯 AI Prediction: AI Model: $253.15 (+2.3%) tomorrow

TSLA — $428.75 (-6.40 / -1.47%)

💡 Catalyst: Delivery numbers watch

🎯 AI Prediction: AI Model: $435.45 (+1.6%) tomorrow

NVDA — $181.81 (+1.98 / +1.10%)

💡 Catalyst: Data center buildout

🎯 AI Prediction: AI Model: $183.46 (+0.9%) tomorrow

COIN — $330.25 (-6.05 / -1.80%)

💡 Catalyst: Crypto market sentiment

🎯 AI Prediction: AI Model: $348.17 (+5.4%) tomorrow

SHOP — $156.57 (+0.36 / +0.23%)

💡 Catalyst: Merchant platform growth

🎯 AI Prediction: AI Model: $153.95 (-1.7%) tomorrow

💡 Today's Insight

📈 **Momentum Rules:** Three consecutive closes above resistance often confirms a technical breakout

📊 Technical Scorecard

🔮 Market Outlook

Tomorrow's watch: Monitor follow-through on today's moves with attention to volume confirmation. Key technical levels holding across most names.

- Support zones: Major 50-DMAs providing technical floors

- Resistance: Recent swing highs acting as supply zones

- Breadth: 1/5 names in bullish setups

📚 Bottom Line

Cautious trading with profit-taking in mega-caps VIX elevated at 25. Key moving averages continue to define trend structure. Monitor volume patterns and breadth for confirmation signals.

Questions? Contact our team · Subscribe for daily updates

Data Sources: Yahoo Finance (real-time market data), SD Panthers AI (ARIMA+ETS+EMA+GBT ensemble predictions)

Methodology: Technical analysis using 20/50 DMAs, volume patterns, 52-week ranges, and AI-powered forecasting